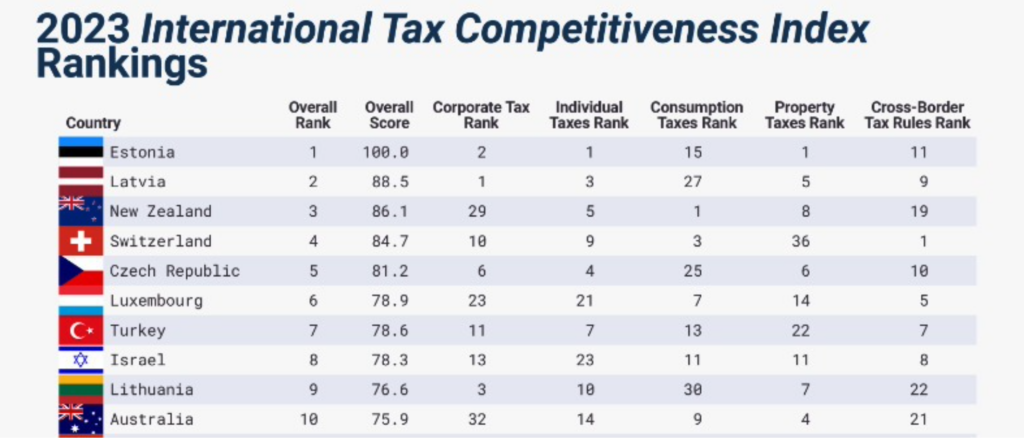

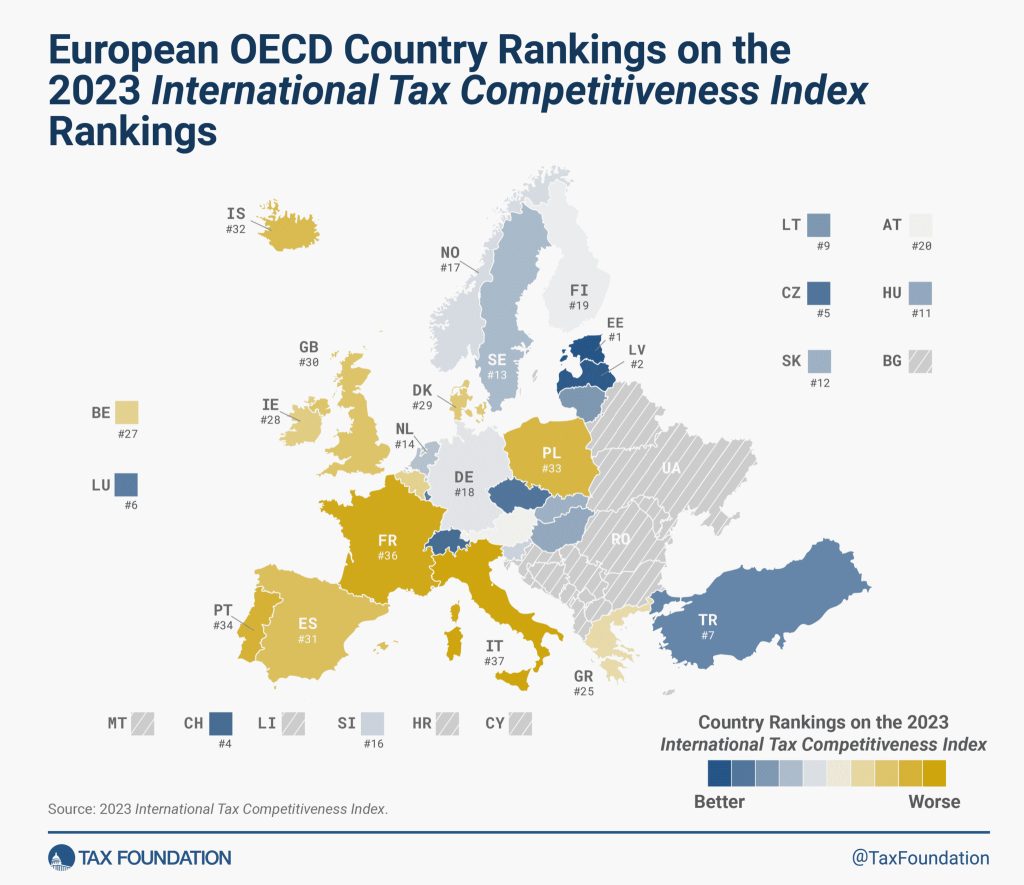

Estonia has secured the top spot in the International Tax Competitiveness Index for the tenth consecutive year. Even with upcoming modifications in its tax regulations and rates, Estonia will remain to have the most competitive tax system in the world.

In 2023, Estonia's tax system was ranked highest in the International Tax Competitiveness Index (ICTI), marking it as the most competitive tax system in the world among OECD nations for the tenth consecutive year.

A robust tax code is crucial for a nation's economic health. It enables taxpayers to comply easily, fostering economic growth and boosting public revenue. In contrast, inefficient tax systems can be burdensome, lead to skewed economic choices, and negatively impact local economies. This is the stance of the Tax Foundation, a US-based tax policy organization and the creator of the ICTI.

Tax systems vary widely among OECD countries, necessitating comparisons to assess their effectiveness. The ITCI, developed by the Tax Foundation, evaluates over 40 tax policy elements to determine the competitiveness and neutrality of national tax codes. This assessment includes corporate and individual income taxes, consumption and property taxes, and the treatment of foreign-earned profits.

Estonia's high ranking in 2023 is attributed to several aspects of its tax system:

- A 20% corporate tax rate on cash-flow, applicable only to distributed profits.

- A flat 20% individual income tax, exempting personal dividend income.

- Property tax limited to land value, not on overall real estate or capital.

- A network of double tax treaties aiding local corporations with foreign tax credits.

Estonian citizens, tax residents, and e-residents benefit from this system. While Estonia isn't a tax haven and e-Residency doesn't exempt from dual tax residency or foreign taxes, its straightforward tax regime and 62 tax treaties offer significant benefits for international entrepreneurs. This includes a transparent business environment and efficient digital services, minimizing compliance costs and tax filing time. E-residents can further align their companies with Estonia's tax residency by establishing a substantial business presence there, such as renting office space, employing staff, registering assets, and conducting board meetings in Estonia.

Consulting a tax specialist is recommended for advice on international tax laws and optimizing corporate tax structures based on geographical location and business operations.

Years of changes in the tax system: 2024-2026

Regarding upcoming tax changes in Estonia, the government has announced tax law revisions to be implemented between 2024 and 2025. These changes primarily involve tax rate increases and the removal of some exemptions, but the tax system will remain straightforward and transparent.

Key upcoming changes for e-Resident businesses include:

From January 1, 2024

20% to 22%, affecting e-resident businesses selling to Estonian consumers and potentially leading to price adjustments.

From January 1, 2025

From January 1, 2025, the corporate income tax rate will increase from 20% to 22%, and the reduced 14% rate will be abolished, affecting profit distribution costs. The personal income tax rate will also increase to 22%, and a uniform tax-free income of 700 euros per month will replace the current system, potentially impacting net salaries and wage dynamics.

Other changes will involve increased CIT payments for credit institutions, higher reduced VAT rates for certain services, progressively rising gambling taxes, and new car and sugar taxes in 2025.

All proposed changes can be found on the Estonian Tax and Customs Board website.

Despite these amendments, there will be no new capital gains or property transfer taxes, and the property tax will continue to apply only to land value. Due to these factors and the ongoing efficiency of Estonia's tax code, the country is likely to remain at the forefront of international tax competitiveness and neutrality within the OECD.

Want to know more about your options? Interested in accessing the EU free market? You are always welcome to book a free 30 minute consultation with us here. Contact us via email at info@nomadbusinesssolutions.eu or visit our website here.